HSA and FSA, how to properly utilize for tax purposes

Both and HSA and FSA can be a great way to put money aside for qualifying medical expenses throughout the year and get a pre-tax contribution on your paycheck.

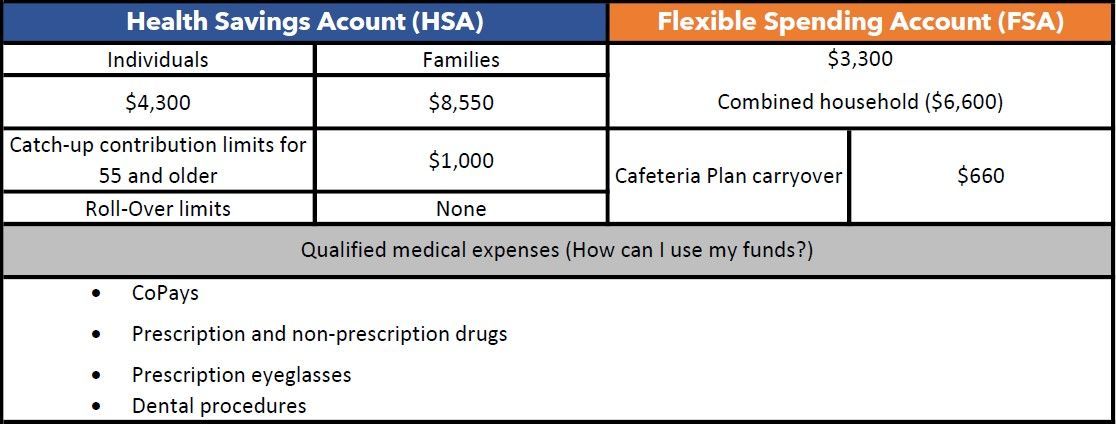

For 2025 there is an increase of $150 for employee-only coverage which represents a 3.6% move higher based on 2024 rates. On the family contributions the limit had an increase of $250 or 3% compared to 2024.

On the combined scenarios the contribution limits are significantly less than the roughly 7 percent increase that was seen from 2023 to 2024.

The IRS has not released as of yet, any changes for the 2025 catch-up contribution for savers age 55 and older and it currently remains at $1,000 the 2024 level.

Also, for 2025, a High-Deductible Health Plan must have a deductible of at least $1,650 for employee only coverage or $3,300 for spouse, children or family coverage compared to $1,600 and $3,200 in 2024.

Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but no premiums) cannot exceed $8,300 for self-only coverage and $16,600 for family coverage for the 2025 plan year.

In addition to the HSA and HDHP changes the IRS has announced that the 2025 HRA limit will be $2,150.

2025 HSA and FSA Contribution Eligibility

HSA: You must have a high deductible health plan (HDHP) to open a health savings account (HSA).

Medical FSA: Can be paired with Medical Plans other than HDHP Plans.

Limited FSA: Can be used for expenses such as Dental and Vision. Participants in a HDHP Medical Plan are eligible.

Tax Information Regarding HSA and FSA Accounts

– It can be a smart way for employees to save for medical expenses, given their triple tax benefits:

- Contributions are made pretax

- The money in the accounts grows tax free

- Withdrawals for qualified medical expenses are tax free.

– If you exceed contributions for either your HSA or FSA accounts the excess amount will be subject to income taxes.

– A tax penalty of 6% will also apply to any amount that is over the contribution limit.

Any mistakes made by exceeding the contribution limit can always be corrected if you withdraw the excess funds before the annual federal tax filing deadline. Interest earned also counts!